We understand trucking is a serious and challenging business. However, trucking is the most common and popular profession among 26 states in the United States. The Owner-Operators owns the truck and drive it hundreds of miles every day. Among all the other truckers, the owner-operator’s job is even more challenging, and they need to spend a lot of time away from their family to carry out their trucking business. So, we serve the most hard-working owner-operators with the world’s pocket-friendly and economical e-filing service. We offer single-vehicle form 2290 returns at $ 7.99 and free VIN correction in case of mistakes or typos.

Truckdues.com significantly reduces the burden of the taxpayers through its user-friendly online platform. It is a complete do-it-yourself website with a simple step-by-step process, and you don’t need to have complete knowledge about form 2290 and IRS regulations. So, you can e-file form 2290 all on your own without any help from third-party taxpayers or paid preparers.

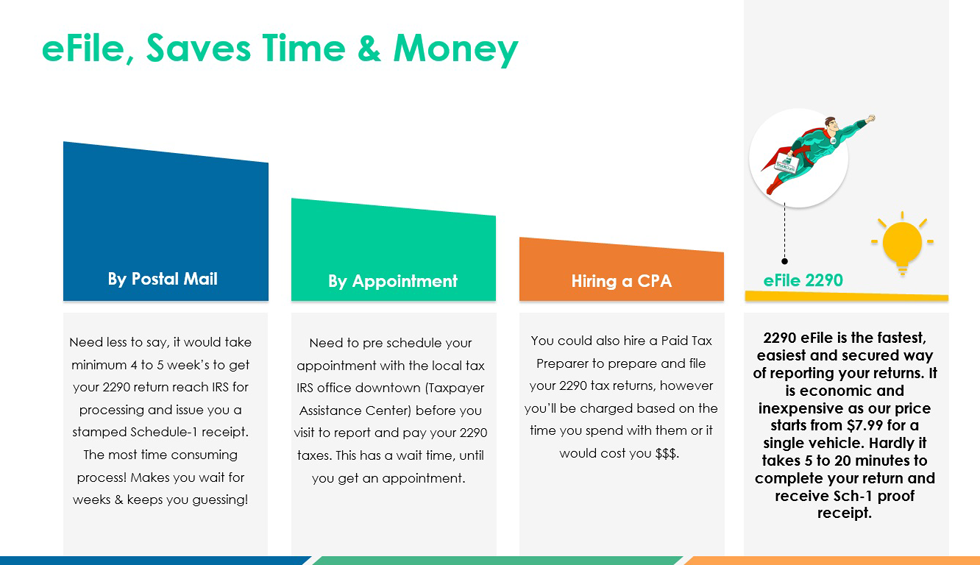

Truckdues.com offers you a highly economical and inexpensive form 2290 online e-filing service. It is the best option than depending on other taxpayers, paid preparers, or third-party taxpayers. Our customer service executives are available to assist you with this e-filing form 2290 process step by step till you complete it successfully. We are witnessing many truckers e-filing their form 2290 truck taxes all by themselves at truckdues.com without depending on any of the third-party taxpayers or paid preparers. It builds confidence and trust in the entire e-filing system, so they return for the next year to fulfill their form 2290 requirements through the e-filing method at truckdues.com and save a lot of money. IRS will issue the official IRS digitally watermarked/stamped schedule 1 copy within a few minutes of approval straight to the email through the e-filing method, which will be very useful in vehicle registration and license plate renewal in a short period. The days you spent fixing up an appointment with the IRS, driving there, spending the time standing in the queue, filling the form 2290 tax returns, and waiting for weeks to get the IRS stamped schedule 1 copy are finally over. You can e-file form 2290 online at truckdues.com at the comfort of your home/office with your personal computer or smartphone anytime you wish.

So, why the wait? Talk to us today, and you might avail of some discounts under special conditions. We’re available for you at 347 – 515 – 2290 or write you can write for us at support@truckdues.com to become a part of our TruckDues community. Hundreds and Thousands of owner-operators are benefiting from the perks of e-filing form 2290 online at truckdues.com. You can also save a lot of money and time through truckdues.com. It is the most economical online platform on the internet for the beloved trucking communities to e-file their form 2290 highway heavy vehicle use tax online.

FAQs

Owner-operators face many more challenges in their line of work than any other trucker in the trucking industry. So, it will be difficult for them to spend so much time preparing their tax form 2290 and directly filing it to the IRS. Also, it won’t be very easy for them to keep records of e-filing track and schedule 1 copy for further auditing and other purposes. So truckdues.com offers a convenient online platform to e-file form 2290 online with simple preparation steps at the comfort of your home/office. You can use your personal computer or smartphone to access truckdues.com and e-file form 2290 online. By e-filing form 2290, you will instantly get the official schedule 1 copy from the IRS to your email, which you can use for all the legal and registration purposes. Also, all your records are maintained and accessible from the dashboard of your TruckDues account.

You can contact our customer support executive at 347 – 515 – 2290. They will answer your queries, clear your doubts and help you in every way to complete your form 2290 online e-filing process smoothly. Our customer support desk is available from 8 AM to 6 PM EST on all business days. Or else, you can write for us at support@truckdues.com. We will attend to your queries as soon as possible.

Paid preparers are third-party tax experts/agents who file your form 2290 truck tax to the IRS on your behalf. They are tax professionals like official tax experts, lawyers, accountant, CPA, etc who prepare and file HVUT form 2290 and other related corrections, amendments, and claims in their client’s favor.

If you have all the necessary information and supporting documents in hand, it will take not more than 10 minutes to complete the entire process and submit your form 2290 tax returns with the IRS at truckdues.com.

Yes, IRS might reject your form 2290 under certain circumstances, mainly when you enter wrong or duplicate VIN, your EIN doesn’t match the IRS record, incorrect EIN, incorrect routing number, etc. However, you can e-file your rejected form 2290 again with the IRS through the same e-filing method at truckdues.com after correcting the mistakes for free of cost.