What is Vehicle Identification Number (VIN)?

Vehicle Identification Number or VIN is a unique identification alphanumeric number of 17 digits given exclusively to a vehicle. VIN is commonly used to identify a particular for legal and other purposes. So, your vehicle’s VIN is important fore-filing form 2290highway road tax online with the IRS. Your official IRS digitally watermarked Schedule 1 copy contains the VIN of the tax filed vehicle, and you can use the copy as proof of filing your form 2290 tax returns with the IRS everywhere.

You should ensure that you enter the correct VIN for the respective vehicle while e-filing the tax form 2290 with the IRS on truckdues.com. You must not enter any duplicates from previous filings or incorrect numbers in the place of VIN.

VIN will not have alphabets like ‘I’ ‘O’ ‘Q’ in it. So, if you enter any of these letters or any of the 17 digits incorrectly, then IRS will not accept your form tax form 2290 e-filing process. Also, our website and mobile applications will not accept the alphabets mentioned above to save you from the trouble of making any typing mistakes while form 2290 reporting.

Reporting a VIN Correction

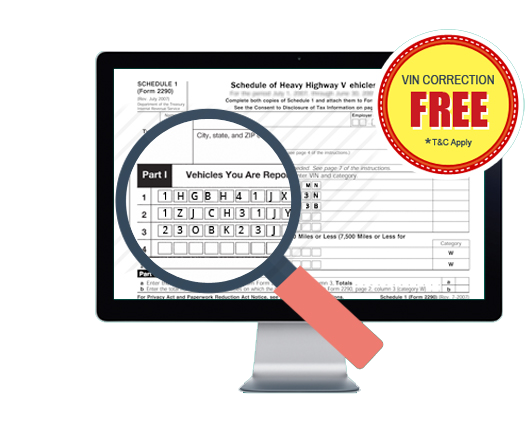

Correction of any duplicates, typing errors in the VIN, and resubmitting the form 2290 returns is called VIN correction. It would be best to make sure that you correctly entered the VIN while filing the form2290 truck tax online. If you did any mistakes in entering the VIN and processing your tax application, you could correct it through the VIN Correction form in truckdues.com. Yes, IRS now introduced the facility of VIN correction through e-filing methods. And truckdues.com provides free VIN corrections for Form 2290 reported through us.

VIN Correction for FREE

Truckdues.com offers FREE VIN corrections for theform 2290highway truck taxes e-filed and processed through TruckDues online platform or application. However, if you filed through any different service provider or paper filing directly with the IRS, then you are not eligible for Free VIN corrections through truckdues.com. Instead, you have to pay a small service charge of $ 9.99 to e-file and do VIN corrections through truckdues.com.

Reporting and E-filing VIN Corrections forms are easy via truckdues.com. You can sign in and register your new account for free. Then choose ‘Start My New Return’ from the menu and select the ‘VIN Correction’ menu.

Purpose of VIN #

Vehicle Identification Number or VIN is a series of 17 digits Arabic numbers and Roman letters assigned to the motor vehicles for identification purposes as per the rules and regulations of the National Highway Traffic Safety Administration (NHTSA). VIN contains information about the vehicle’s origin, manufacture, and production serial number, making it easy to identify and understand more about the vehicle.

The VIN serves as the unique identification feature for a motor vehicle. The identification number is necessary for law enforcement officials to identify and classify the particular vehicle as an anti-theft mechanism and insurance companies to identify the vehicles. And VIN is also used to identify the vehicles in crash investigation programs,registration, and titling.

The VIN system is essential to increase the accuracy and efficiency of vehicle recall campaigns undertaken to remedy non-compliance with the Federal Motor Vehicle Safety Standards (FMVSS) or defects related to motor vehicle safety.

VIN is unique for every motor vehicle. No two vehicles have the same VIN for them. It is like a fingerprint for a vehicle where no vehicle has the same.

VIN is a unique alphanumeric code that can be classified into three parts,

- World Manufacturer Identifier

- Vehicle Descriptor Section

- Vehicle Identifier Section

Each new vehicle in the United States of America comes with a Window Sticker (Monroney Sticker) that contains all the important information about the vehicle, such as type of the vehicle, color, year of manufacture, MSRP (Manufacturer’s Suggested Retail Price), technical specifications, standard and optional equipment installed, fuel economy ratings according to federal release.

FAQs

You should apply for VIN corrections once you notice the incorrect VIN in your official Schedule 1 copy for your form 2290 tax returns. Then, you should again re-apply for VIN Corrections and get the correctedSchedule 1 copyof your 2290 tax form.

Yes, you can apply for VIN corrections online through e-filing methods using truckdues.com. E-filing VIN correction is the easiest, secure and economical way to get it done quickly.

E-filing for VIN correction is absolutely free if you e-filed your existing form 2290 tax returns through truckdues.com. If not, you will be charged $ 9.99 to get your form 2290 VIN corrections done online.

Yes, VIN correction is free if you filed your original truck tax form 2290 through truckdues.com. Otherwise, you will be charged a service fee to e-file your VIN corrections through truckdues.com.

You will receive the new revised Schedule 1 copy for your truck tax form 2290 with an official IRS digital watermark within a few minutes of your e-file approval.

VIN serves as a unique identification code for your vehicle. It makes the IRS system easily identify your vehicle. So, you must produce your VIN while reporting your form 2290 highway use tax with the IRS.

VIN is usually found on the Window Sticker of every vehicle in the United States. No two vehicles will have the exact VIN. It is unique for each vehicle and mandatory for all the legal processes, including registration and2290 road tax.

The VIN corrections are to correct the TYPOs in your Vehicle Identification Number while reporting the IRS Tax Form 2290. The IRS allows to change up to 3 characters in a VIN Correction return. If you want to change the entire VIN, the IRS won’t allow you to do so.